Fundamental Analysis Crypto: A Deep Dive into Digital Asset Strategies

As digital asset markets continue to fluctuate, understanding the fundamental analysis of cryptocurrency has never been more crucial. With over $4.1 billion lost to DeFi hacks in 2024 alone, investors must equip themselves with the right tools and knowledge to navigate this volatile landscape. This article aims to demystify fundamental analysis in the crypto sphere, providing insights that can enhance your investment strategies.

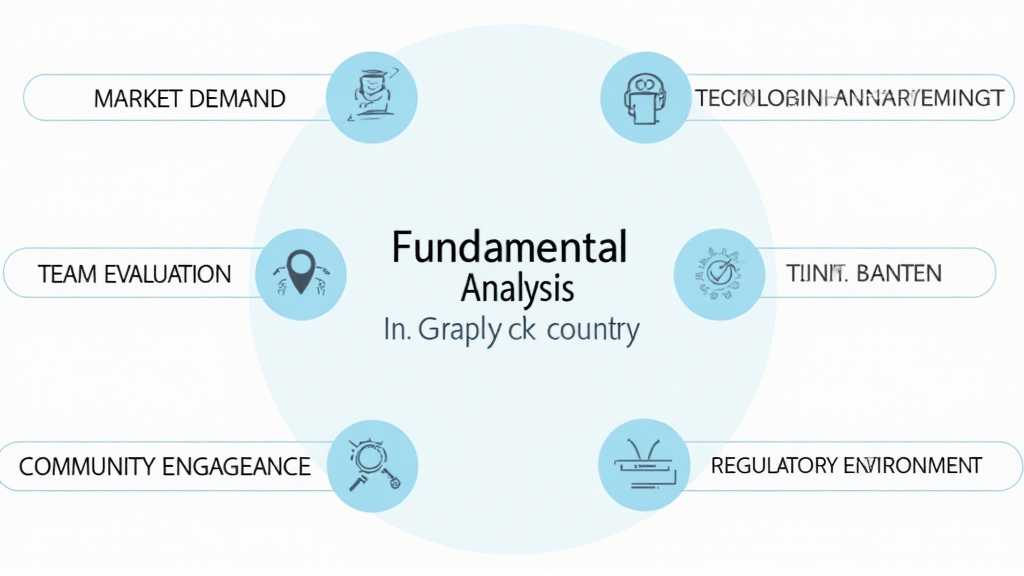

What is Fundamental Analysis in Crypto?

Fundamental analysis involves evaluating a cryptocurrency’s intrinsic value by examining both quantitative and qualitative factors. Much like assessing the health of a traditional stock, it allows investors to determine a coin’s legitimacy and potential for growth. Here’s how it works:

- Market Demand: Analyzing the supply and demand factors that affect a cryptocurrency’s value.

- Technological Advancements: Evaluating the underlying technology, its use cases, and innovations.

- Team and Development: Investigating the team behind a project and its track record.

- Community Engagement: Understanding the community support and active participation in the project.

- Regulatory Environment: Considering how regulations impact the cryptocurrency’s viability in the market.

Understanding Market Demand

A significant factor in fundamental analysis is market demand. A cryptocurrency can show potential for growth if it meets a particular need or solves pressing problems. For instance, stablecoins like USDT are increasingly popular due to their ability to facilitate transactions while maintaining price stability. In regions like Vietnam, where digital payment solutions are gaining traction, the use of cryptocurrencies continues to rise.

In Vietnam, the user growth rate for crypto was approximately 38% in 2024, highlighting significant interest in digital assets. This data indicates that investors should keep an eye on how demand trends change over time, especially in emerging markets.

Evaluating Technological Advancements

The technology underpinning a cryptocurrency is paramount. Just like a bank vault secures physical assets, blockchain technology provides security and transparency for digital currencies. Evaluating the network’s speed, scalability, and transaction costs can provide critical insights into its future success.

Examples include:

- Ethereum’s Smart Contracts: Establishing a decentralized platform for applications.

- Solana’s High Transaction Speed: Offering an alternative for DeFi applications with lower fees.

- Bitcoin’s Security Protocols: Ensuring the overall safety of the network against hacks.

The Importance of Team and Development

The team behind a cryptocurrency project is often a key indicator of its potential for success. A seasoned team with a strong background in blockchain technology and finance can inspire investor confidence. Look for:

- Team members with verified LinkedIn profiles.

- Previous successful projects and their impact on the market.

- Regular updates and transparent communication with their community.

Case Study: Chainalysis Insights

According to a Chainalysis report from 2025, top-performing cryptocurrencies often have strong leadership and consistent communication. Those involved in the top-tier projects frequently have backgrounds in leading tech companies, providing additional credibility to their ventures.

Understanding Community Engagement

In the crypto landscape, community involvement is often a good indicator of a project’s health. A vibrant community can lead to greater adoption and ongoing demand. Engaging with users through social media platforms, AMAs (Ask Me Anything), and forums enables real-time feedback and fosters loyalty.

For example, on platforms like Reddit, proactive community engagement has been well-documented to correlate with price stability and growth.

Navigating the Regulatory Environment

The regulatory landscape can be both a boon and a bane for cryptocurrency growth. Regulatory clarity can enhance investor confidence while restrictions can stifle market advancement. Here’s what you should consider:

- Keep an eye on laws being passed in your respective country.

- Analyze how regulations affect crypto exchange operations.

- Understand the tax implications associated with crypto transactions.

Conclusion: Tools for Effective Fundamental Analysis

Investing in cryptocurrency requires a meticulous approach to fundamental analysis. By comprehensively evaluating market demand, technological advancements, team engagement, community support, and the regulatory landscape, you can make informed decisions that align with your investment goals.

Moreover, employing practical tools can mitigate risks. For example, hardware wallets like the Ledger Nano X have been shown to reduce hacking risks by up to 70%, providing a safeguard for your assets.

Remember, as with any investment, it’s essential to do your research and consult local regulators for tailored advice. Here at wavexcoins, we encourage our readers to stay informed and make sound investment choices.

Author: Dr. Alex Tran

Dr. Alex Tran is a renowned cryptocurrency analyst with over a decade of experience in blockchain technology. He has published more than 15 research papers on digital assets and has led multiple audits for well-known blockchain projects.