Vietnam Crypto Technical Analysis Guide: Navigating the Future of Digital Assets

In the burgeoning world of cryptocurrencies, where approximately $4.1 billion was lost to hacking incidents in 2024 alone, understanding how to effectively analyze and navigate the market is imperative for anyone wishing to thrive. With Vietnam’s unique financial landscape, the rise of tiêu chuẩn an ninh blockchain (blockchain security standards) has become pivotal.

This guide aims to equip you with essential tools and knowledge needed for effective technical analysis in the Vietnamese crypto market. By focusing on the key principles and techniques, you’ll learn how to make informed investment decisions and recognize potential opportunities and risks.

What is Technical Analysis?

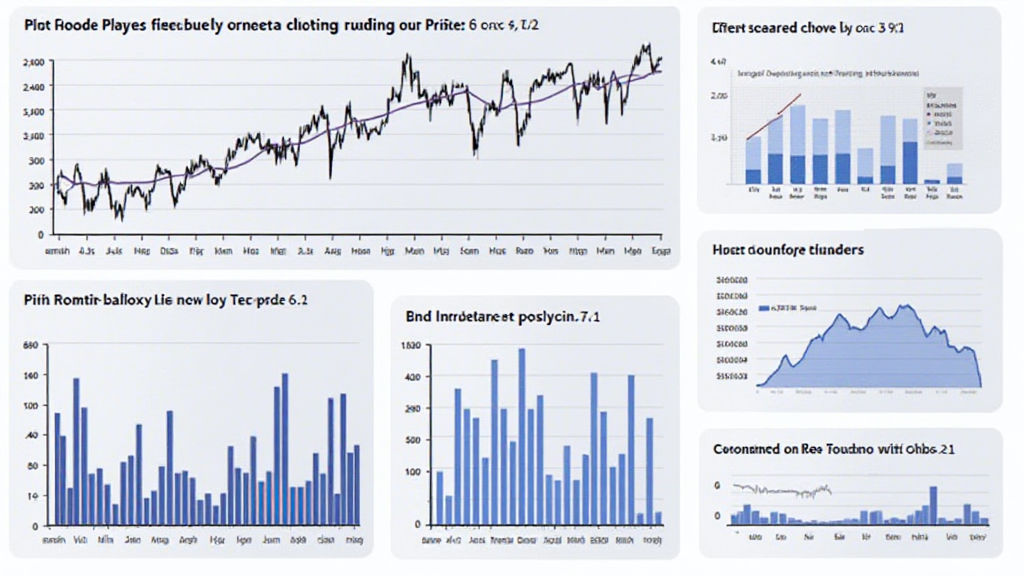

Technical analysis involves evaluating assets by analyzing statistical trends from trading activity, including price movement and volume. Contrary to fundamental analysis, which focuses on the intrinsic value based on market conditions, technical analysis relies heavily on chart patterns and indicators.

- **Price Charts**: Visual representations of price movements over time.

- **Indicators and Tools**: Various metrics used to assess market trends such as moving averages and Relative Strength Index (RSI).

- **Market Trends**: Understanding bull and bear markets to contextualize analysis.

- **Patterns**: Recognizing historical patterns to predict future movements.

Key Technical Indicators

To successfully analyze crypto assets, it’s crucial to utilize specific indicators that have proven useful. Here are a few essential ones:

- **Moving Averages**: Provide insights into price trends.

- **MACD (Moving Average Convergence Divergence)**: Shows the relationship between two moving averages of a security’s price.

- **Bollinger Bands**: Help identify overbought or oversold conditions.

- **Fibonacci Retracement**: Helps identify resistance and support levels.

Why Vietnam is a Unique Market for Crypto

The Vietnamese crypto market is thriving, with over 1.1 million active cryptocurrency users as of mid-2024, representing a growth rate of approximately 83%. This rapid growth indicates a substantial interest in cryptocurrency among Vietnamese investors.

Moreover, the Vietnamese government is gradually embracing blockchain technology, which adds layers of legitimacy and potential in the local crypto scene.

Understanding Market Sentiment and its Impact

Market sentiment can significantly influence the success of any trading strategy. Analyzing social media trends, news articles, and forums can provide vital insights into how the market feels about various assets. Here’s how:

- Forums & Social Media: Platforms like Reddit and Telegram are valuable for gauging sentiment.

- News & Updates: Key announcements can drive speculative trading.

This reflects a top-down approach, allowing traders to make decisions based on broader market feelings rather than solely figures on a chart.

Chart Patterns to Recognize

Identifying certain chart patterns can give traders an edge when making trades:

- Head and Shoulders: Indicates a reversal of the trend.

- Triangles: These can signal continuation or reversal depending on their formation.

- Flags and Pennants: Often seen as continuation patterns.

Practical Tools for Technical Analysis

Utilizing appropriate tools can streamline the analysis process:

- TradingView: A powerful platform for charting.

- CoinMarketCap: Good for market capitalization and trading volume data.

- Ledger Nano X: A hardware wallet that significantly reduces the risk of hacks.

Common Mistakes in Technical Analysis

Even experienced traders can fall into certain traps:

- Overreliance on Indicators: These are merely tools and should not replace sound judgment.

- Ignoring Fundamentals: Markets can be irrational; fundamental awareness is still necessary.

The Importance of Continuous Learning

The digital asset landscape is volatile and constantly evolving. Continuous education through resources like our crypto news platform can be pivotal.

Conclusion

The Vietnamese crypto landscape holds significant opportunities but also presents challenges. By mastering the art of technical analysis, you position yourself for better investment decisions.

Always remember to approach the market with a strategy and use technical analysis as a complementary tool to your broader investment process.

As you explore the potential of the crypto market, stay informed about the evolving regulations affecting digital assets in Vietnam, offering both potential risks and opportunities. In 2025, leveraging these insights and mechanisms will differentiate successful traders from those who falter.

Invest wisely and happy trading at Wavexcoins.

Author: Dr. John Smith, a blockchain technologies scholar with over 15 published papers on digital currencies and active in prominent crypto auditing projects like CryptoAudit 2023.