Liquid Staking Derivatives (LSD) Trends: What’s Next for Investors?

In the rapidly evolving world of cryptocurrency, one area has shown immense potential for innovation and growth: Liquid Staking Derivatives (also known as LSDs). As of 2024, the liquid staking market has soared, with billions of dollars locked in various protocols. This uptick leads to a fundamental question: how will trends in liquid staking derivatives influence the broader market? In this article, we will delve into the current trends surrounding liquid staking derivatives, the implications for investors, and insights into the evolving landscape in regions like Vietnam, where cryptocurrency adoption is on the rise.

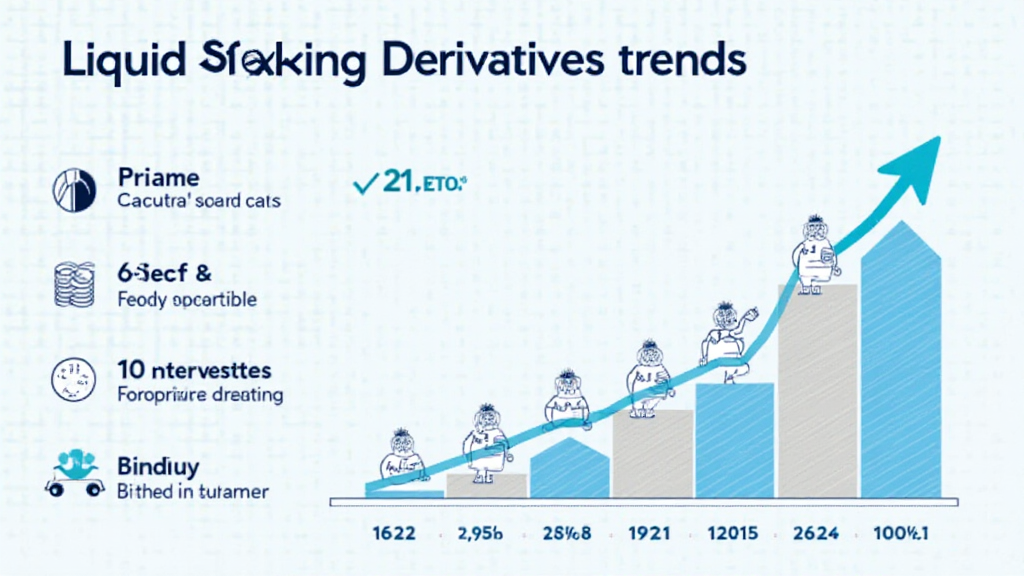

The Rise of Liquid Staking Derivatives

Just as banks allow you to access liquidity while your funds are still in savings accounts, liquid staking derivatives give you the flexibility to stake your cryptocurrency and still retain liquidity. As of early 2024, the total market value of liquid staking derivatives reached approximately $12 billion, growing from just $4 billion in late 2022. With the upcoming Ethereum upgrades enhancing staking capabilities, more investors are actively participating.

One of the most noteworthy developments in liquid staking is the introduction of LSD protocols that allow for cross-chain compatibility, enabling investors to stake across multiple blockchains without losing flexibility. This shift reflects a growing trend towards enhancing user experience and increasing value for investors. Moreover, as institutions look to integrate staking into their portfolios, the demand for liquid staking derivatives is likely to increase dramatically.

Key Benefits of Liquid Staking Derivatives

- Enhanced Liquidity: Investors can trade their staked assets without waiting for the typical unbonding period.

- Yield Generation: Users can earn rewards from staking while still engaging in other DeFi activities.

- Risk Mitigation: Diversifying strategies can reduce exposure to the volatility of individual tokens.

- Capital Efficiency: LSDs enable users to maximize their returns on digital assets while maintaining access to liquidity.

Challenges Ahead for Liquid Staking Derivatives

Despite their promising advantages, liquid staking derivatives are not without challenges. With evolving regulatory frameworks, users must stay informed about the potential changes that may impact the liquidity and usability of their assets. Recent regulatory developments in the United States and Europe indicate increasing scrutiny that could impact the LSD space. Investors may experience fluctuations in yields and face uncertainties regarding the long-term viability of specific protocols.

Another potential pitfall is the risk of liquidity slippage during high volatility periods. Much like in traditional finance, during market downturns, liquidity can dwindle rapidly, making it harder for investors to exit positions without significant slippage.

Vietnam’s Growing Market for LSDs

Vietnam is an exciting example of how markets are adapting to liquid staking derivatives. As of 2023, cryptocurrency adoption in Vietnam is expected to grow by over 40%, with more young professionals and tech enthusiasts eager to invest in digital assets. The Vietnamese regulatory landscape is beginning to accommodate cryptocurrencies, paving the way for increased participation in advanced financial products like liquid staking derivatives.

Currently, local reports indicate that platforms providing liquid staking options are gaining popularity in Vietnam, reflecting a trend toward innovative investment strategies. With initiatives aimed at boosting financial literacy among the general population, we anticipate more investors exploring how to harness the power of LSDs responsibly.

Looking Ahead: What to Expect from LSDs in 2025 and Beyond

The trajectory of liquid staking derivatives is arguably promising. As blockchain networks continue to evolve, and more projects launch with integrated staking features, the landscape for LSDs will likely expand. We could see:

- Increased Institutional Investment: More investment firms are expected to engage with liquid staking due to its yield-generating capacity and liquidity advantages.

- Regulatory Clarity: As regulatory environments stabilize, clearer frameworks surrounding liquid staking could emerge, fostering a safer investment climate.

- Technological Advancements: Enhanced protocols could improve security and efficiency, leading to wider adoption.

- Broader Ecosystem Interoperability: Future developments may prioritize compatibility across various chains, promoting collaboration among networks.

In conclusion, while Liquid Staking Derivatives present numerous opportunities, investors should maintain a keen awareness of the associated risks. Engaging with these innovative financial products could reshape how investors interact with cryptocurrencies and decentralized finance. As the market matures, understanding the future trends in liquid staking derivatives will be vital for any serious cryptocurrency investor.

Wrapping Up

In a market as dynamic as cryptocurrency, liquid staking derivatives stand out as a critical development, offering flexibility that traditional staking does not provide. As adoption continues to rise in regions like Vietnam, and as the various challenges are addressed, staying updated with market trends in LSDs may be one of the most crucial steps for investors looking to broaden their cryptocurrency portfolio.

The trends in liquid staking derivatives (LSD) will undoubtedly influence the future of crypto investments significantly. For both novice and seasoned investors, understanding these trends will be key to navigating the evolving landscape securely and profitably.

For more insights and resources on Liquid Staking Derivatives and other emerging trends in cryptocurrency, visit WavexCoins today.

Author: Dr. Minh Nguyen – An expert in blockchain technology and financial instruments, Dr. Nguyen has published over 25 papers focused on crypto economics and has led audits for prominent projects in Vietnam’s crypto space. Always advocating for safe and informed investment strategies in the digital asset space.