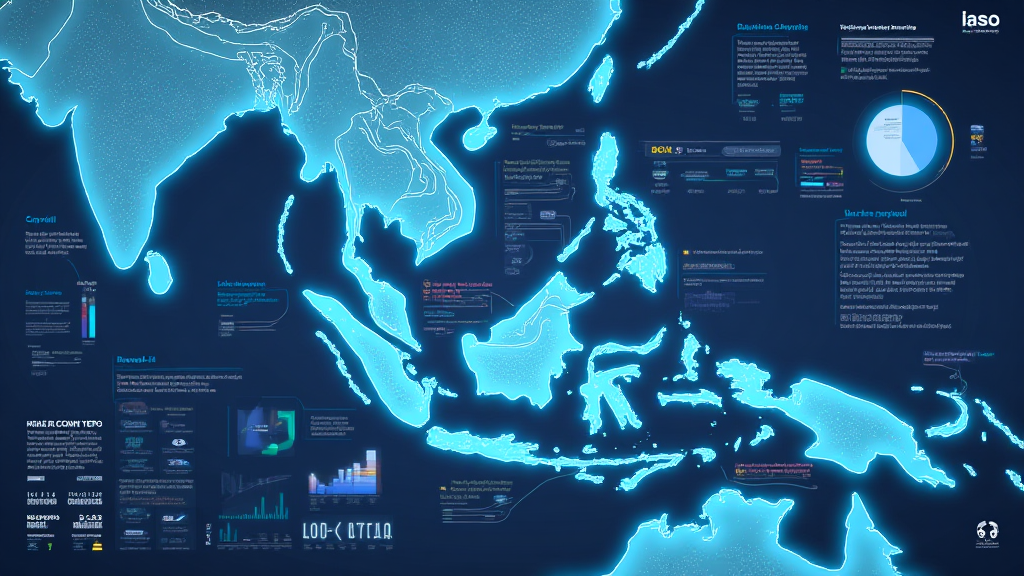

Southeast Asia Crypto Market Outlook 2026

As we look ahead towards 2026, the Southeast Asia crypto market is poised for substantial evolution and growth. With advancements in blockchain technology and a burgeoning interest in digital assets, this region represents a vibrant landscape for both investors and innovators.

In 2024 alone, the crypto industry experienced a loss of $4.1 billion due to various DeFi hacks. This staggering figure raises questions about security protocols, regulatory measures, and user trust. Consequently, it’s crucial to assess not just the potential for investment returns, but also the integrity and safety of platforms in this dynamic sector.

This article aims to provide a comprehensive outlook on the Southeast Asia crypto market by analyzing growth trends, significant regulatory developments, and emerging opportunities. We will uncover the driving forces behind user adoption and examine how local dynamics shape the market.

Current Landscape of the Crypto Market in Southeast Asia

The current state of the crypto market in Southeast Asia is characterized by rapid growth and increased user engagement. According to research, the crypto user base in Vietnam has grown by approximately 150% in the past year alone, indicating a strong appetite for digital assets.

- Vietnam: Quick adoption of cryptocurrencies, spearheaded by a younger demographic interested in technology.

- Thailand: Legal frameworks supporting crypto transactions have attracted more investors.

- Philippines: A surge in remittance-driven crypto adoption positions the country as a notable player in the region.

Regulatory Challenges and Opportunities

Regulatory frameworks play a critical role in shaping the future of the crypto market. With governments across Southeast Asia taking varied approaches to regulation, it is vital to understand how these frameworks impact market dynamics.

- Thailand: The Thai SEC has established a legal framework promoting токены (tokens) as an integral facet of financial strategy.

- Vietnam: While regulations remain in flux, initiatives for clearer blockchain standards are being pursued (see tiêu chuẩn an ninh blockchain).

- Malaysia: Comprehensive licensing for crypto exchanges indicates a move towards embracing the sector.

Investment Trends for 2026

The investment landscape in the Southeast Asia crypto market is marked by several trends that are likely to dominate through 2026.

- DeFi platforms: As users seek to maximize returns, decentralized finance remains a focal point.

- NFTs: Non-fungible token markets are expected to grow further, mixing art, music, and gaming industries.

- Cross-border payments: The need for streamlined international transactions will bolster the crypto adoption further.

User Behavior and Adoption Rates

The behavior of users across Southeast Asia is shifting profoundly, with increasing rates of adoption attributed to several factors including technology accessibility, education, and changing attitudes towards finance.

- Youth engagement: The tech-savvy youth is actively engaging in crypto trading and investment.

- Awareness programs: Local initiatives aimed at educating the masses about blockchain technology are proving effective.

- Social media marketing: Cryptocurrencies are gaining traction on platforms like TikTok, leading to higher visibility.

Forecast for 2026: What to Expect

Looking forward to 2026, several predictions can be made about the Southeast Asia crypto market:

- Revenue growth: The market is projected to reach a valuation of over $50 billion.

- Increased institutional interest: Larger financial institutions will begin engaging with crypto assets, lending greater credibility to the sector.

- Integration with traditional finance: Expect more crypto-friendly banking solutions to emerge.

As we dissect the Southeast Asia crypto market outlook for 2026, it is essential for stakeholders and investors to stay informed about the developing trends, potential pitfalls, and vast opportunities within the region. To thrive, one must navigate the complexities of regulatory environments while capitalizing on innovative use-cases that resonate with the local audience.

For investment strategies, understanding how to audit smart contracts is imperative to safeguarding assets in this evolving market. Tools for enhancing blockchain security and ensuring compliance with local regulations should be prioritized.

If you aim to succeed in the fast-evolving landscape of crypto, being proactive about regulatory changes and market dynamics is your best approach.

In conclusion, the Southeast Asia crypto market outlook for 2026 presents a fertile ground for investment, armed with unique challenges and plentiful opportunities. Harnessing the growth potential requires sound knowledge of the local market and a commitment to continuous learning and adaptation. For further insights, visit wavexcoins.

Conclusion

Keep an eye on evolving trends, significant regulatory updates, and emerging technologies like blockchain for ensuring you remain at the forefront of this thrilling sector.

As we wrap up our exploration of the Southeast Asia crypto market outlook for 2026, remember that accurate forecasting and strategic investment remain critical for success. The rise of cryptocurrency is reshaping financial landscapes, making it a pivotal time to engage with this dynamic market.