Introduction: The Rise of Crypto Liquidity in Vietnam

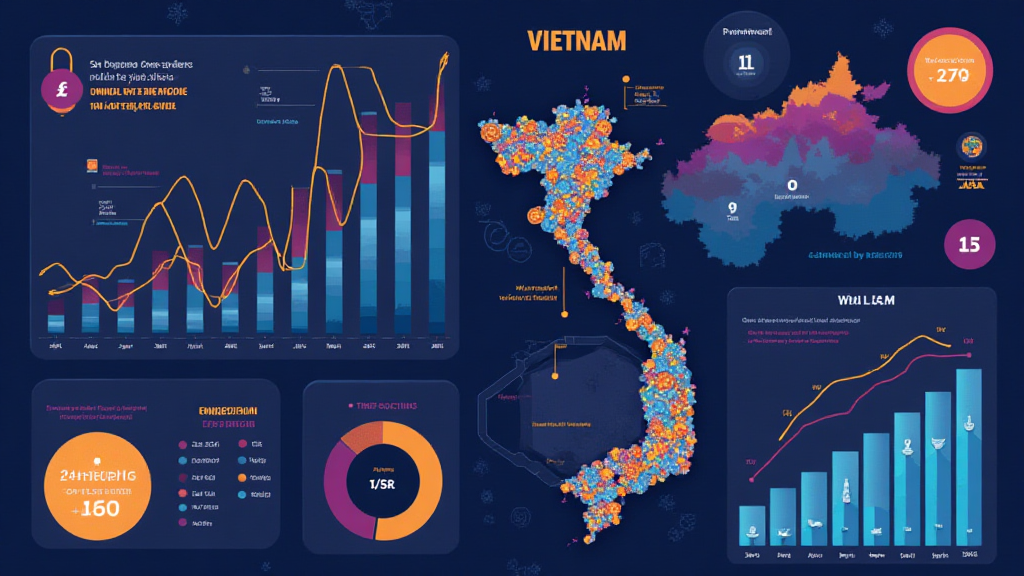

As Vietnam’s cryptocurrency market matures, a striking statistic has emerged: over 5 million Vietnamese currently engage in some form of cryptocurrency trading. This rapid user growth represents a compelling opportunity for businesses and investors alike.

However, the question on everyone’s mind is: Is the crypto liquidity in the Vietnam market robust enough to support this growing interest? As we delve into this topic, we will explore not only the current state of crypto liquidity but also the potential for future growth, considering local regulations and market dynamics.

Understanding Crypto Liquidity: What Does It Mean?

Crypto liquidity refers to how easily a cryptocurrency can be bought or sold in the market without causing significant price changes. Much like a traditional bank’s liquidity, where funds can be accessed and utilized, crypto liquidity also plays a critical role in the functioning of digital asset markets.

In Vietnam, the popularity of cryptocurrencies like Bitcoin and Ethereum is soaring. However, the liquidity levels in these markets can fluctuate dramatically based on various factors, including regulatory actions, market trends, and technological advancements.

The Landscape of Crypto Liquidity in Vietnam

According to recent reports, Vietnam’s crypto market has witnessed impressive growth, characterized by increased trading volume and user engagement. By 2025, it is projected that the number of crypto holders in Vietnam will surpass 10 million.

- **Current trading volume:** The average daily trading volume for top cryptocurrencies in Vietnam now exceeds $200 million.

- **User growth rate:** The user base is growing at an estimated 45% annually, driven by increased interest in blockchain technology.

- **Investment opportunities:** Early adopters are keen on investing in emerging altcoins, indicating shifts in trading behavior.

Market Drivers of Crypto Liquidity in Vietnam

Several key drivers contribute to the burgeoning crypto liquidity in Vietnam:

- Regulatory Framework: Vietnam’s government is in the process of establishing clearer regulations regarding cryptocurrency, such as tiêu chuẩn an ninh blockchain, ensuring a safer trading environment that encourages participation.

- Tech-savvy Population: With a highly educated workforce, younger generations lead the charge in adopting digital assets, significantly impacting liquidity.

- Innovative Platforms: The rise of localized trading platforms, catering to the Vietnamese market, has further enhanced accessibility and ease of trading.

Challenges Affecting Crypto Liquidity in Vietnam

While the prospects for crypto liquidity are bright, several challenges remain:

- Volatility: Cryptocurrency markets are known for their unpredictable price swings, which can deter potential investors.

- Limited Banking Support: Traditional banks in Vietnam have been hesitant to support cryptocurrency transactions, creating a barrier for many users.

- Security Concerns: Despite advancements in technology, the risk of hacks and scams remains high, affecting investor confidence.

Optimizing For Future Growth

The future of crypto liquidity in Vietnam looks promising, buoyed by the following key strategies:

- Improving Infrastructure: Investment in technology and infrastructure that supports real-time trading can significantly enhance liquidity.

- Educational Initiatives: Informing potential investors about trading strategies, security measures, and regulatory compliance can foster a more robust trading environment.

- Partnerships with Financial Institutions: Collaborating with local banks can pave the way for smoother transactions and increased liquidity.

Conclusion: The Future Landscape of Crypto Liquidity in Vietnam

In conclusion, the crypto liquidity in the Vietnam market stands at a critical juncture. The blend of government support for regulatory clarity and the enthusiasm of the population creates a fertile ground for future growth. However, stakeholders must remain vigilant and address the existing challenges head-on.

With ongoing improvements and the right strategic approaches, there’s no doubt that Vietnam could become a leading player in the global cryptocurrency landscape.

As we move forward, it’s essential for investors to stay informed and engage with established platforms like wavexcoins to navigate this exciting market effectively.

About the Author

Dr. Minh Khai is a blockchain technology expert and a financial analyst, with over 15 published papers focusing on cryptocurrency regulations and market analysis. He has led several significant audits in the blockchain sector, establishing himself as a noteworthy authority in this rapidly evolving space.