Introduction

With over $4.1 billion lost to DeFi hacks in 2024, understanding tokenomics has never been more critical. Tokenomics, or the economic model behind cryptocurrencies, is a vital component for investors, developers, and enthusiasts. This guide aims to provide comprehensive insights into tokenomics analysis, helping you navigate the complexities and identify opportunities in the ever-evolving crypto landscape.

What is Tokenomics?

Tokenomics refers to the study of the economic model and structure of a cryptocurrency or token. It encompasses aspects such as the total supply of tokens, distribution mechanics, utility, and how they function within their respective ecosystems. Just like a well-designed economic system, an effective tokenomics model can significantly influence the success and sustainability of a project.

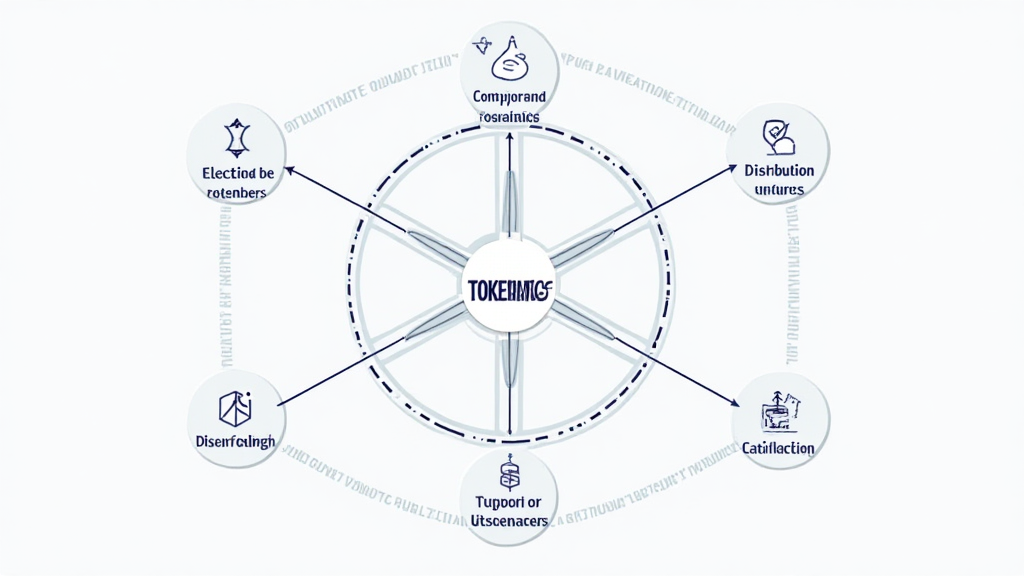

Here are some key components of tokenomics:

- Total Supply: The maximum number of tokens that will ever be created.

- Distribution: How tokens are allocated to stakeholders, developers, and the community.

- Utility: The functional purpose of the token within its ecosystem.

- Incentives: Mechanisms to encourage usage and investments, such as staking rewards.

Decentralization vs Centralization

Each cryptocurrency’s tokenomics model can lean towards either decentralization or centralization. For instance, Bitcoin’s decentralized network versus a centralized project like Ripple illustrates the contrasting approaches. Understanding these dynamics is crucial for potential investors.

Analyzing Tokenomics: Key Factors

When diving deep into tokenomics, several critical factors deserve your attention:

1. Supply and Demand Dynamics

Just like any market, the crypto market is driven by supply and demand. Projects that limit the total supply of their tokens can create scarcity, which in turn may drive up value. Understanding these dynamics helps assess a token’s potential for growth.

2. Distribution Models

Token distribution can play a pivotal role in market perception and stability. A fair distribution model ensures that no single entity holds excessive power, making the ecosystem more resilient against market manipulation.

3. Utility and Use Cases

The practical function of a token within its ecosystem cannot be overstated. Tokens that have legitimate use cases—like enabling transactions, staking, or governance—tend to attract greater interest and investment. Analyzing these use cases can reveal the sustainability of a project.

4. Incentive Mechanisms

Effective incentive structures encourage ongoing participation in a network. This can include rewards for holding tokens, staking, or governance participation. Projects that implement compelling incentives can cultivate strong community engagement.

5. Market Trends and Analytics

Keeping an eye on market trends and objective analytics can provide insights into the future performance of tokens. Resources like hibt.com can equip you with the necessary data insights.

Real-World Examples

To better grasp tokenomics, let’s take a look at some real-world examples:

1. Ethereum (ETH)

Ethereum’s transition to a proof-of-stake model highlights significant shifts in tokenomics. By making staking essential for network validation, it creates an avenue to earn rewards while simultaneously reducing the circulating supply through token burns.

2. Binance Coin (BNB)

BNB’s ecosystem utility as a utility token within the Binance exchange shows how economic models foster engagement, from trading fee discounts to token buy-backs, encouraging participants to hold rather than sell.

Tokenomics in Vietnam’s Crypto Market

The Vietnamese crypto market is rapidly evolving, with a user growth rate of over 56% recorded in 2023. Investors across this region are increasingly focusing on tokenomics to identify lucrative opportunities. Projects that effectively communicate tokenomics principles tend to foster engagement and drive investments in the Vietnamese market.

As the Vietnamese digital asset ecosystem matures, local regulations like tiêu chuẩn an ninh blockchain will play an essential role in shaping tokenomics frameworks and ensuring investor protection.

Tools for Tokenomics Analysis

Utilizing the right tools can enhance your tokenomics analysis. Some recommended resources include:

- DeFi Pulse – For tracking DeFi metrics and trends.

- CoinMarketCap – For accessing real-time market data.

- Messari – Offers deep insights and analytics on various crypto projects.

Conclusion

Understanding tokenomics is crucial for making informed investment decisions in the crypto space. By thoroughly analyzing various aspects such as supply dynamics, distribution models, utility, and incentives, you can identify promising projects that are poised for growth. As we look towards the future, adopting a well-rounded approach to tokenomics will empower investors to navigate the complexities of this digital asset landscape.

Stay updated with the latest trends and insights by following wavexcoins, your trusted source for crypto analyses and investment guidance. Remember, effective tokenomics can unlock the potential of any cryptocurrency!

Author: John Smith, PhD, Cryptocurrency Analyst with 15 publications and a lead auditor for the Blockchain Innovations Project.